Digital transformation in fintech is more than simply a trend in the ever-evolving field of financial technology; it signals a tremendous wave of change that is transforming how we handle our money.

Fintech businesses are at the forefront of the digital revolution, utilizing cutting-edge tools to change the way we manage our finances, make investments, and do business.

The Fintech Revolution

Fintech, an abbreviation for financial technology, encompasses a broad spectrum of digital innovations designed to enhance and streamline financial services. This diverse sector includes both startups and established financial institutions, all working towards adapting to the digital age.

The essence of fintech digital transformation lies in a shift towards more efficient, customer-centric, and technologically-driven financial solutions.

Exploring Fintech Digital Transformation

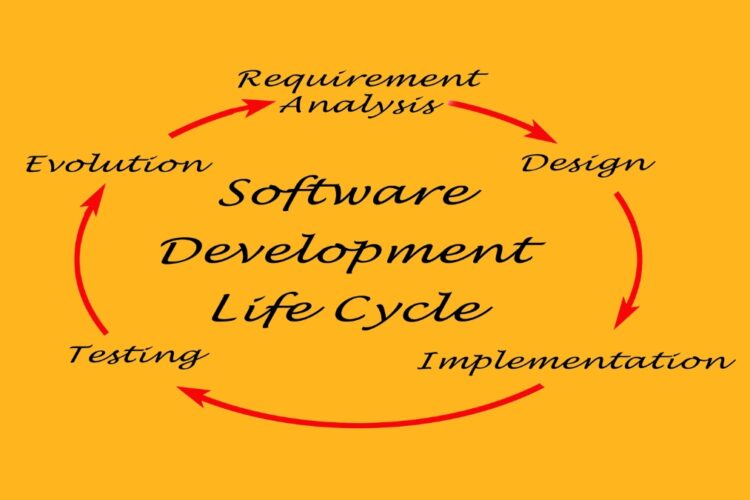

At its core, digital transformation in fintech involves reimagining traditional financial processes by incorporating technology solutions. This involves harnessing the power of artificial intelligence, blockchain, big data analytics, and mobile applications to create smoother and more user-friendly financial services.

The ultimate goal is to provide customers with financial services that are not only accessible but also more efficient, thus enhancing their overall financial experiences.

The Forces Driving Fintech Digital Transformation

Several factors are driving the digital transformation in fintech:

- Customer Expectations: In a world where convenience is paramount, customers expect financial services to be seamless and readily accessible. This pressure compels fintech companies to continuously adapt to remain competitive.

- Regulatory Changes: The ever-evolving landscape of financial regulations necessitates swift adaptation and often demands digital solutions to ensure compliance.

- Emerging Technologies: The rapid advancement of technologies like blockchain, artificial intelligence, and cloud computing opens doors to innovation and cost savings in the fintech sector.

- Competition: Fintech startups, with their agility and cost-effective services, are challenging traditional financial institutions, compelling established players to embrace digital transformation to stay relevant.

The Role of Outsourcing in Fintech

Outsourcing has re-emerged as a strategic solution to address these challenges. Fintech firms are increasingly turning to outsourcing partners to tap into specialized skills and expertise, streamline their operations, and speed up their time-to-market. Here’s why outsourcing is making a strong comeback:

- Cost Efficiency: Outsourcing can substantially reduce operational costs, allowing fintech companies to allocate their resources more efficiently.

- Access to Talent: Not all fintech startups have the resources to hire in-house experts across every domain. Outsourcing provides access to a global pool of skilled professionals.

- Focus on Core Strengths: By outsourcing non-core functions such as customer support or data entry, fintech firms can concentrate on what they excel at—innovating and enhancing their core offerings.

- Scalability: Outsourcing partners have the flexibility to quickly scale up or down as needed, ensuring adaptability in a rapidly changing fintech landscape.

- Speed to Market: Outsourcing accelerates the development and deployment of products, enabling fintech companies to stay ahead of market trends.

Key Considerations of Outsourcing

While outsourcing presents numerous advantages, it’s important to be aware of the challenges involved. Fintech companies should take into account the following factors:

- Security: Data security is of utmost importance in fintech. Choosing the right outsourcing partner with robust security measures is crucial.

- Regulatory Compliance: Fintech firms must ensure that their outsourcing partners adhere to industry-specific regulations and standards.

- Effective Communication: Successful collaboration relies on effective communication to bridge geographical and cultural gaps when working with outsourced teams.

The Impact of Fintech Digital Transformation

The consequences of fintech digital transformation are far-reaching, influencing various facets of the financial industry:

- Enhanced Customer Experience: Through user-friendly interfaces and personalized services, customers can now manage their finances with greater ease and control.

- Improved Efficiency: Automation of manual processes reduces operational costs and minimizes errors, benefiting both businesses and customers.

- Innovation in Products: Fintech companies continually introduce new financial products and services that cater to specific customer needs, such as robo-advisors, peer-to-peer lending, and digital wallets.

- Financial Inclusion: Digital transformation enables broader access to financial services, reaching underserved populations who previously lacked access to banking facilities.

- Data-Driven Insights: Fintech leverages big data analytics to provide customers with personalized financial recommendations and insights into their spending habits.

- Reduced Fraud: Advanced security measures, such as biometrics and blockchain, help mitigate fraud and enhance the security of financial transactions.

Challenges and Obstacles

While the benefits of fintech digital transformation are evident, it is not without its challenges:

- Cybersecurity Concerns: As financial transactions move online, the threat of cyberattacks increases, necessitating robust security measures to protect sensitive data.

- Regulatory Compliance: Adhering to ever-changing financial regulations and ensuring data privacy can be complex and costly for fintech companies.

- Legacy Systems: Traditional financial institutions often grapple with outdated legacy systems that hinder their ability to adapt quickly to new technology.

- Consumer Trust: Building trust in digital financial services remains a hurdle, as many consumers remain skeptical of online transactions and data security.

Success Stories in Fintech Digital Transformation

Several fintech companies have demonstrated the potential of digital transformation in reshaping the industry:

- Square: This payment processing company disrupted the market by providing small businesses with easy-to-use mobile payment solutions, transforming how they accept payments.

- Robinhood: Known for its commission-free trading app, Robinhood democratized investing and attracted millions of users, showcasing the power of fintech to reshape investment services.

- Adyen: A global payment company that enables businesses to accept payments in various currencies and payment methods, streamlining cross-border transactions.

- Stripe: Stripe’s online payment processing platform simplifies the payment process for businesses, making it easier to accept payments online.

The Road Ahead

As digital transformation in fintech continues to evolve, several trends are shaping the future of the industry:

- Decentralized Finance (DeFi): DeFi platforms leverage blockchain technology to provide financial services outside traditional banking systems, offering greater accessibility and transparency.

- Artificial Intelligence (AI) and Machine Learning: AI-driven solutions will continue to improve fraud detection, risk assessment, and customer service in fintech.

- Blockchain and Cryptocurrencies: The adoption of blockchain technology and cryptocurrencies is expected to revolutionize how financial transactions are conducted and recorded.

- Open Banking: Enhanced data sharing and collaboration between FinTech companies and traditional financial institutions will lead to more innovative and integrated services.

- Sustainability: Fintech companies are increasingly focusing on sustainable finance, offering products and services that align with environmental, social, and governance (ESG) principles.

Conclusion

The financial technology industry is undergoing a digital change that is more than a passing fad. It might revolutionize the financial sector by making it more accessible, convenient, and innovative than ever before. In terms of customer service, productivity, and access to credit, FinTech’s digital revolution is reshaping the financial industry and will likely continue to do so in the future.

As businesses and financial institutions navigate this transformative journey, seeking guidance and expertise is essential. With its extensive knowledge of fintech digital transformation, Codesy Consultancy can be an invaluable asset in guiding businesses to use technology in this dynamic environment successfully. In short, if you want to keep up with the rapidly developing fintech industry, you’ll need to embrace digital transformation.